A brand new use case for bitcoin is inflicting a stir due to its capability to incorporate information straight on-chain. An evaluation of inscriptions’ affect on block area.

The under is an excerpt from a latest version of Bitcoin Journal PRO, Bitcoin Journal’s premium markets publication. To be among the many first to obtain these insights and different on-chain bitcoin market evaluation straight to your inbox, subscribe now.

Bitcoin Ordinals And Inscriptions

A latest and considerably contentious use of Bitcoin is an modern software of the Taproot mushy fork that was merged into the protocol in 2021. Ordinal Idea is a approach of serializing every particular person unit of bitcoin and labeling these particular satoshis “ordinals.” The creator of this numbering scheme, Casey Rodarmor, described it in his weblog saying, “Satoshis are numbered within the order during which they’re mined, and transferred from transaction inputs to transaction outputs in first-in-first-out order.”

By serializing these particular person satoshis and using the Taproot improve, Bitcoin customers can even embody arbitrary information straight on the blockchain. Whereas this was already potential with textual content utilizing the OP_RETURN perform, these new “inscriptions” might be something from jpegs, quick sound clips and even easy video games.

There’s rising debate within the growth group concerning the implications of storing all this information straight on Bitcoin and what which means for customers who need to run a full archival node. Whereas this dialogue is essential, we need to dig into how inscriptions are at the moment impacting Bitcoin’s price market and the way it may look sooner or later.

Environment friendly Use Of Block House

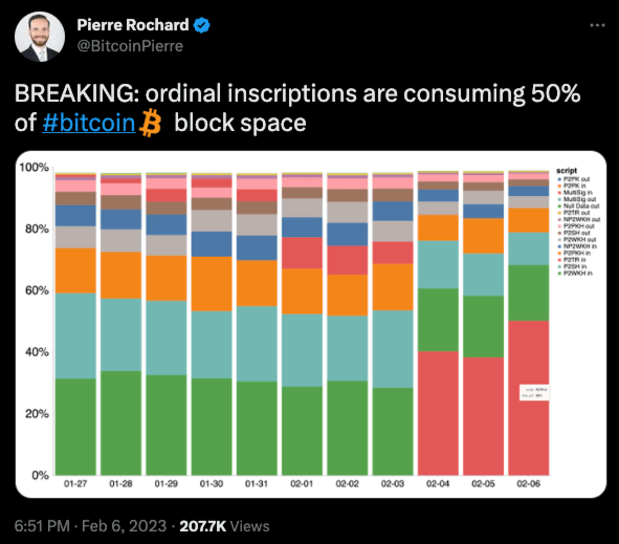

By their nature, inscriptions are bigger recordsdata and subsequently take up extra of the finite area in every Bitcoin block. The customers which might be creating inscriptions are required to pay the required charges with the intention to ship their transactions, nevertheless, inscriptions are included in witness information which is given a slight price low cost due to the SegWit mushy fork in 2017.

Ordinals formally launched on January 21, 2023. Lower than three weeks later, inscriptions are already taking over 50% of Bitcoin’s block area in accordance with Pierre Rochard, vice chairman of analysis at Riot Platforms.

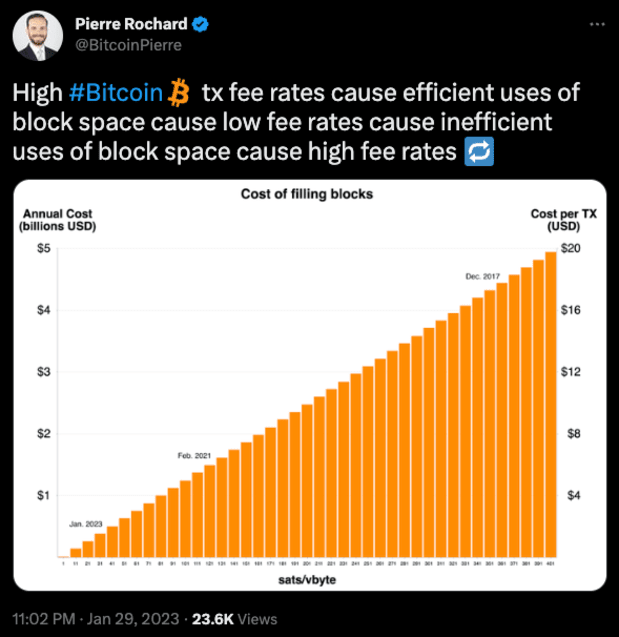

Bitcoin’s price market is a continually altering panorama. Charges rise when demand to transact on-chain is excessive and customers need to get their transaction included within the subsequent block. Inversely, the price fee drops when demand is low and customers don’t want their transactions confirmed in a well timed method.

Whether or not or not these inscriptions must be thought of an “acceptable” use of Bitcoin, the market will determine the suitable price pricing for individuals who want to embody this arbitrary information into every block. Ought to transaction charges rise sufficient, it’s possible that much less essential or smaller bitcoin transactions will probably be priced out of the market and transfer to Layer 2 protocols, comparable to Lightning. These extra layers had been at all times the game-theoretical speculation of Bitcoin’s price construction, even predicted by Hal Finney in 2010.

Historic Block Weight

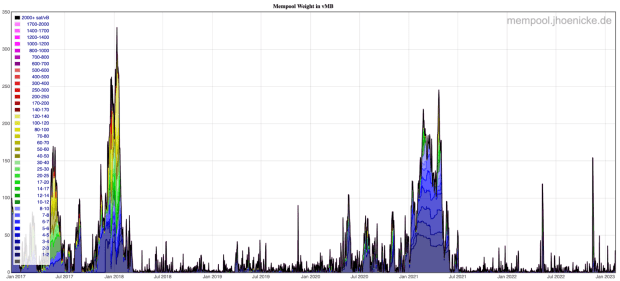

This isn’t the primary time {that a} vital variety of transactions have stuffed the mempool. As famous, Bitcoin’s price market is dynamic and the cycle of excessive charges create environment friendly makes use of of block area, create low charges, create inefficient use of block area, create excessive charges will repeat advert infinitum.

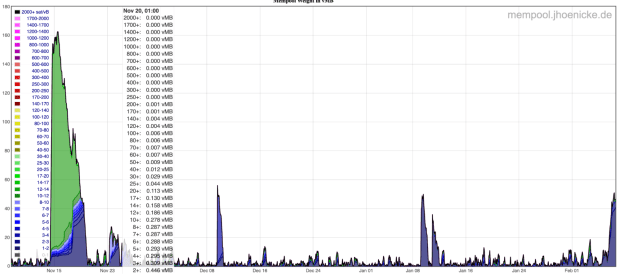

Proven under is mempool information and price costs going again to the start of 2017. Blockspace tends to be at a premium throughout bull runs as many individuals are sending bitcoin forwards and backwards from exchanges or chilly storage or spending it on the comparatively excessive change fee.

Zooming in on the previous three months, it’s clear that there was a major variety of transactions taking place within the second half of November as bitcoin flew off exchanges with customers defending themselves from every other potential contagion occasions.

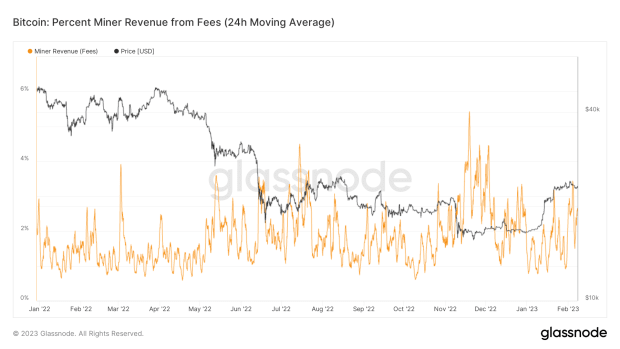

Past excessive instances, transaction charges have been low for lengthy stretches of time and have led to questions on Bitcoin’s long-term safety finances because the block subsidy dwindles and charges should turn into a bigger proportion of bitcoin miners’ income. Once more, the speculation from Bitcoin proponents is that demand for block area will enhance over time as bitcoin positive aspects adoption and scales, inflicting extra utilization emigrate to different layers constructed on high of the protocol.

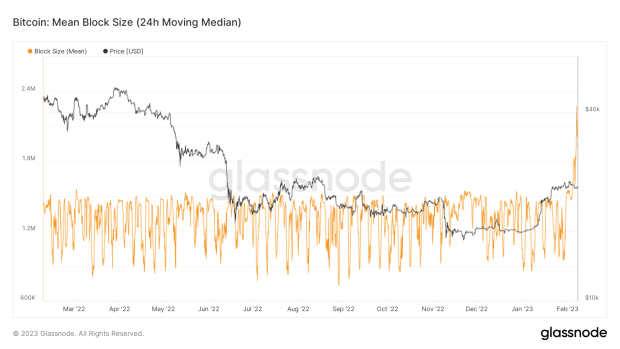

In the previous few weeks, the common block measurement has seen an enormous spike.

Even with this main enhance in block measurement, price market competitors has but to warmth up. It’s possible that those that want to ship financial transactions will enhance their charges to get their transaction included extra rapidly or those that need to mint an inscription with out having to attend will do the identical. Both approach, ought to charges enhance, so will profitability for miners who would acquire extra income within the block reward within the type of increased transaction charges.

Transaction charges are nonetheless an insignificant proportion of the mining block reward, falling someplace between 1% and three%. Will charges start to rise as increasingly more folks try to make use of bitcoin for sending cash and minting inscriptions?

Like this content material? Subscribe now to obtain PRO articles straight in your inbox.

Related Previous Articles:

- State Of The Mining Trade: Survival Of The Fittest

- The Crypto Contagion Intensifies: Who Else Is Swimming Bare?

- Not Binancial Recommendation

- This Time Isn’t Completely different: Miners Are Largest Threat Going through Bitcoin Market In Repeat of 2018 Cycle

- BM Professional Market Dashboard Launch!

from Bitcoin – My Blog https://ift.tt/0wszAIe

via IFTTT

No comments:

Post a Comment