Bulletins by authorities businesses make stricter rules look imminent for the crypto business. How derivatives market motion impacts the bitcoin worth.

The under is an excerpt from a current version of Bitcoin Journal PRO, Bitcoin Journal’s premium markets publication. To be among the many first to obtain these insights and different on-chain bitcoin market evaluation straight to your inbox, subscribe now.

Crypto In The Crosshairs

On February 9, bitcoin’s alternate price gave up a few of its year-to-date positive aspects as headlines of accelerating regulatory crackdown on the broader crypto business got here throughout the newswire. The SEC introduced prices towards Kraken for the promoting of unregistered securities because of the agency’s crypto staking product choices. Equally, the New York Division of Monetary Providers introduced an investigation into Paxos, the issuer of the Pax Greenback and the BUSD Binance stablecoin.

Whereas the regulator’s issues aren’t immediately associated to bitcoin itself, there may be rising chatter of a new-era Operation Choke Level throttling the crypto business. In easy phrases, Operation Choke Level was a controversial initiative launched by the federal authorities which used the Federal Deposit Insurance coverage Company (FDIC) to cut back entry to the U.S. banking system for sure “high-risk,” however (principally) authorized industries. Whereas there is no such thing as a doubt that there was loads of fraud and legal exercise intertwined all through varied elements of the crypto business, some are frightened that the heavy hand of the state may hurt trustworthy actors if regulators create burdensome hurdles which have extensive ranging limitations. For instance, some people who find themselves nonetheless all for staking their crypto would possibly now select to seek out an offshore and sketchy alternate to take action, placing their property much more in danger than earlier than. We’ve written about a few of the issues with yield choices in “Collapsing Crypto Yield Choices Sign ‘Excessive Duress.’”

Bitcoin Market Dynamics

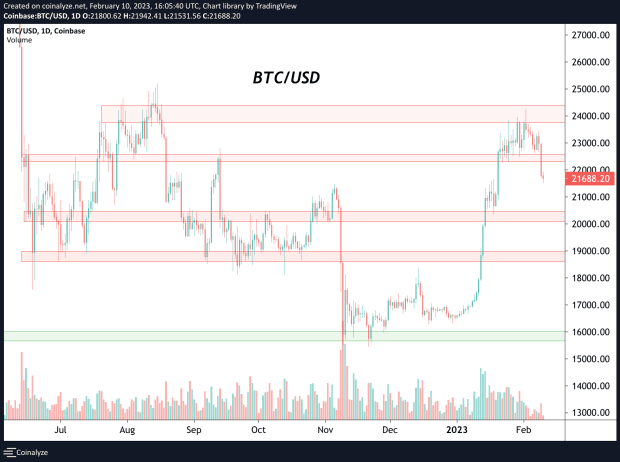

In regard to the bitcoin worth motion, one may presume that the newsflow was the reason for the current native downturn, however there have been varied indicators of native exhaustion after an explosive rally throughout the day by day timeframe.

The present dynamic within the bitcoin market is as follows:

- Bitcoin’s provide is inelastic because it has ever been resulting from extraordinarily sturdy HODLer dynamics.

- Danger-on/risk-off flows dominate, with greenback energy and fairness markets deciding a lot of the course for the bitcoin worth within the quick time period.

- The intense lack of order e-book liquidity for BTC will result in unstable strikes in each instructions, with liquidity at post-FTX collapse ranges regardless of the restoration from the November 2022 lows.

- Bitcoin remains to be vary certain between the $16,000 and $24,000 ranges till the market decisively decides in any other case. Anticipate the pinball match between bulls and bears to proceed for a while.

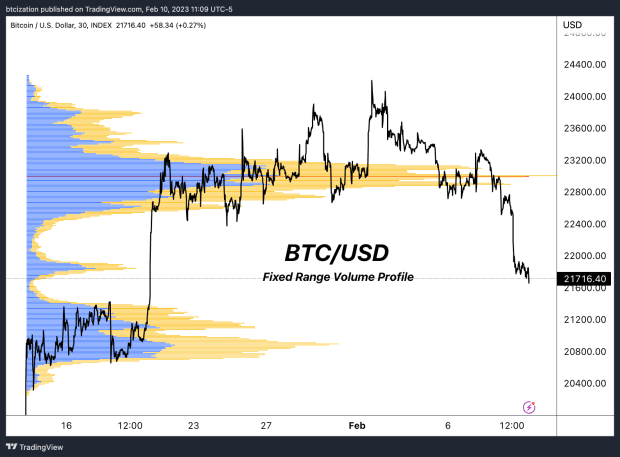

From a quantity perspective, the market at present finds itself in a significant liquidity hole because of the quick squeeze that led to costs reaching their current 2023 highs. Quantity assist sits across the $21,200 degree, with extra consumers ready within the barracks between $19,000 and 20,000.

Bitcoin Derivatives

The futures and derivatives market has been comparatively quiet for the reason that short-squeeze-fueled rally that led to the numerous outperformance to start out the 12 months. Throughout speedy intervals of worth appreciation, discover the demand for calls as proven by a unfavorable skew. Lengthy-call and short-put methods are two completely different ways in which this dynamic can develop and might function a tailwind for the market till imply reversion happens.

The futures market is not signaling bitcoin is within the depths of its contagion, however remains to be very removed from the overheated ranges seen throughout the bull market that helped carry in regards to the leverage collapse that toppled the market like a home of playing cards.

Spot inflows are a should for any significant squeeze place to manifest and break bitcoin out of its seven-month vary.

Like this content material? Subscribe now to obtain PRO articles immediately in your inbox.

Related Previous Articles:

- No Coverage Pivot In Sight: “Increased For Longer” Charges On The Horizon

- Bitcoin Rips To $21,000, Shorts Demolished In Largest Squeeze Since 2021

- Collapsing Crypto Yield Choices Sign ‘Excessive Duress’

- The Crypto Contagion Intensifies: Who Else Is Swimming Bare?

- A Rising Tide Lifts All Boats: Bitcoin, Danger Property Soar With Elevated World Liquidity

- Inflationary Bear Market Spells Hassle For Buyers

from Bitcoin – My Blog https://ift.tt/UpCLbjS

via IFTTT

No comments:

Post a Comment